Vinay Kshirsagar

About the Author

A science Graduate & Chartered Accountant with more than 30 years of experience in finance and accounts.

Working as CFO of Indian Register of Shipping since 2012.

Forecasting of Exchange Rates models ©

How it is done? - Very Simple. "We will ask you the opinion on the various economic factors (such as Interest rate, Inflation, Growth rate, Current account deficit as a % of GDP, Crude oil, Per Capita Income, Foreign Direct Investment as a % of GDP). We will also provide the guidance for you so that you can form your opinion and views easily. Fill the columns and get the forecasted exchange rate within a second!"

Features:

1. You can select either of the model ( Yearly / Semi-annually/ quarterly) or Package of all the three models which will give forecast based on your perception and views2. After selecting any one of the above option you can calculate the forecasted results on three occasions giving different inputs in that option.

Advantages:

Help in formulating hedging strategy for exporter and importer.Planning for long term/ short term foreign loan/ borrowing strategy.

On the basis of your inputs to model, you can predict the exchange rate for future years too. Thus the exchange rate can be predicted for 2019, 2020, 2021 and onwards. Use Model for forecasting

To understand the model in detail refer our Ebook or Hard copy of Book.

All models are tested on the past data and it gives over 90% dependencies.

Review and Comments

I have gone through the models designed by Mr. Vinay Kshirsagar & Mr. Omkar Kshirsagar. The Models have been built by taking into consideration of the data on various Economic parameters for India and USA of last 36 years from 1980 to 2016.

The said input data used for these models is not tested for or validated by me on the assumption that the data taken is correct, unbiased and satisfies the condition of uniformity. The models have been worked out by using Mathematical method, Exponential smoothing average method and Moving Average method. For exponential smoothing method the value of smoothing constant is taken as 0.7 for this value logical explanation is given. Even in Moving average method weights are 0.55, 0.3, 0.1 and 0.05 which represent the proportion of the impact.

All the 3 models are tested for goodness of fit. The method used is regression analysis. This confirms the applicability of the model. The results show- Multiple correlation over 90%, dependency over 85%, significantly lower standard error, residual graph having random pattern, Significant F value ( P-value of overall model is less than 0.05 ). This shows all values are well within the acceptable limits which confirm the overall work-ability of the models to forecast the exchange rate.

Although some coefficients individually doesn't properly indicate the changes in exchange rate however all the coefficients together greatly influences the movement of exchange rate with very high degree of accuracy.

Also considering that the future prediction can never be 100% accurate however this Model is tested with past data for its fitness. The actual results are compared for the Financial years 2016 and 2017. Only the time will confirm its accuracy in the years to come.

I understand from authors that major Economic variables which impact the exchange rate are considered in building the model.

Further when asked about the removal of variables having insignificant impact on the model on the principle of p value and multicollinearity, it has been clarified that the author has done extensive research and evolve this model which has high degree of correlation and dependency. If one of the variables is removed in long runs it impacts. The final combination of these 7 variables gives the best results.

We wish authors all the very best in their future endeavours.

Mrs. Milan Gholba

Retd. Associate Professor,

Department of Statistics,

VPM’s B. N. Bandodkar College of Science, Thane

Dated: 28th September 2017

Contents of foreword of 2nd Edition by Mr. Tarun Jain - CFO of Vedanta Group

1st Edition was Published by Vikas Publication in 2015

1st Edition was Published by Vikas Publication in 2015

(Now Revised and updated Second Version)

USD INR Forecast and Risk Management Techniques in 2017

USD INR Forecast and Risk Management Techniques in 2017

AN INNOVATIVE THOUGHT

This book throws light on various factors/determinants that have a direct or indirect connection with the currency exchange rate, that is, the Indian Rupees vs the US dollar. Additionally, factors such as interest rate, growth rate, inflation have been explained in detail with appropriate examples and graphical representations, providing a clear picture of the whole scenario on how these factors influence the currency exchange rate, both positively and negatively.

What will you get from this book?

- India and USA’s data for last 36 years analyzed and ascertained impact of 7 important variables on exchange rate.

- New idea, thinking approach, analytical method for evaluating & studying the impact of these variables on exchange rate.

- A mathematical, exponential smoothing and moving average models and their regressions exhibiting the relationship and correlation with the exchange rate.

- All models are tested on the past data and it gives over 90% dependencies.

- Forecasting of Exchange Rates based on tested models mathematically and statistically.

- Giving effect of non-quantifying variables, reasonable estimations can be made.

- Help in formulating hedging strategy for exporter and importer.

- Explained various foreign exchange hedging techniques.

- Planning for long term/ short term foreign loan/ borrowing strategy.

- The workability of the model with respect to past data and regression result have been vetted by Senior respected personality in Statistics.

If anyone wants to purchase hard copy of the book, the same is published by Career Point Publications and is available on their website (www.cppublication.com).

The book is also available on Amazon & major book shops of metro cities shortly

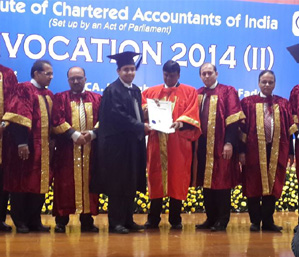

Omkar V. Kshirsagar

Presently working as a Manager - Treasury - Non SLR - Equity in Axis Bank

A Chartered Accountant - (May 2014),

Diploma in IFRS - (June 2015) and Financial Risk Manager (FRM - GARP) - (November 2016), having post qualification experience of 3.5 years and having more than 1 year experience in Treasury including foreign exchange and derivatives. Currently working in Non SLR - Equity department.